Georgia payroll tax calculator 2020

This includes tax withheld from. If you want to simplify payroll tax calculations you can.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Taxpayers now can search for their 1099-G and 1099-INT on the Georgia Tax Center by selecting the View your form 1099-G or 1099-INT link under Individuals.

. Check the 2020 Georgia state tax rate and the rules to calculate state income tax 5. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Georgia Taxable Wage Base. Georgia new employer rate. All Services Backed by Tax Guarantee.

Ad Process Payroll Faster Easier With ADP Payroll. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Free Unbiased Reviews Top Picks. This 1099-G form is for. Calculate your state income tax step by step 6.

Discover ADP Payroll Benefits Insurance Time Talent HR More. 9 per year of the underpayment use Form 600 UET to compute the penalty and 5 of Georgia income tax imposed for the taxable year-48-7-120 and 48-7-126 The combined total of the. Your household income location filing status and number of personal.

Figure out your filing status work out your adjusted gross income. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB. This means that higher income is taxed at a higher rate.

Based Specialists Who Know You Your Business by Name. In the income box labelled 1 enter the annual salary of 10000000. Ad Process Payroll Faster Easier With ADP Payroll.

To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Georgia withholding tax Georgia uses a progressive tax system for personal income tax with a top rate of 575 for 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Salary Paycheck Calculator Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. All Services Backed by Tax Guarantee. This guide is used to explain the guidelines for Withholding Taxes.

After a few seconds you will be provided with a full breakdown. Discover ADP Payroll Benefits Insurance Time Talent HR More. Features That Benefit Every Business.

Ad Payroll Made Easy. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Rates include an administrative assessment of 006.

Get Started With ADP Payroll. Georgia SUTA wage base limit for 2020 is 9500. Starting as Low as 6Month Start Free Trial Simple Paycheck Calculator General Information Total Earning Salary State Pay Cycle Marital status Number of Qualifying Children under Age.

In the field Number of Payroll Payments Per Year enter 1. The following steps allow you to calculate your salary after tax in Georgia after deducting Medicare Social Security Federal Income Tax and Georgia State Income tax. The Georgia State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Georgia State Tax Calculator.

Ad Compare This Years Top 5 Free Payroll Software. We also provide State. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Get Started With ADP Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself. The Georgia Department of Labor is responsible for unemployment wages for the state of Georgia.

The tax calculator will automatically calculate the.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

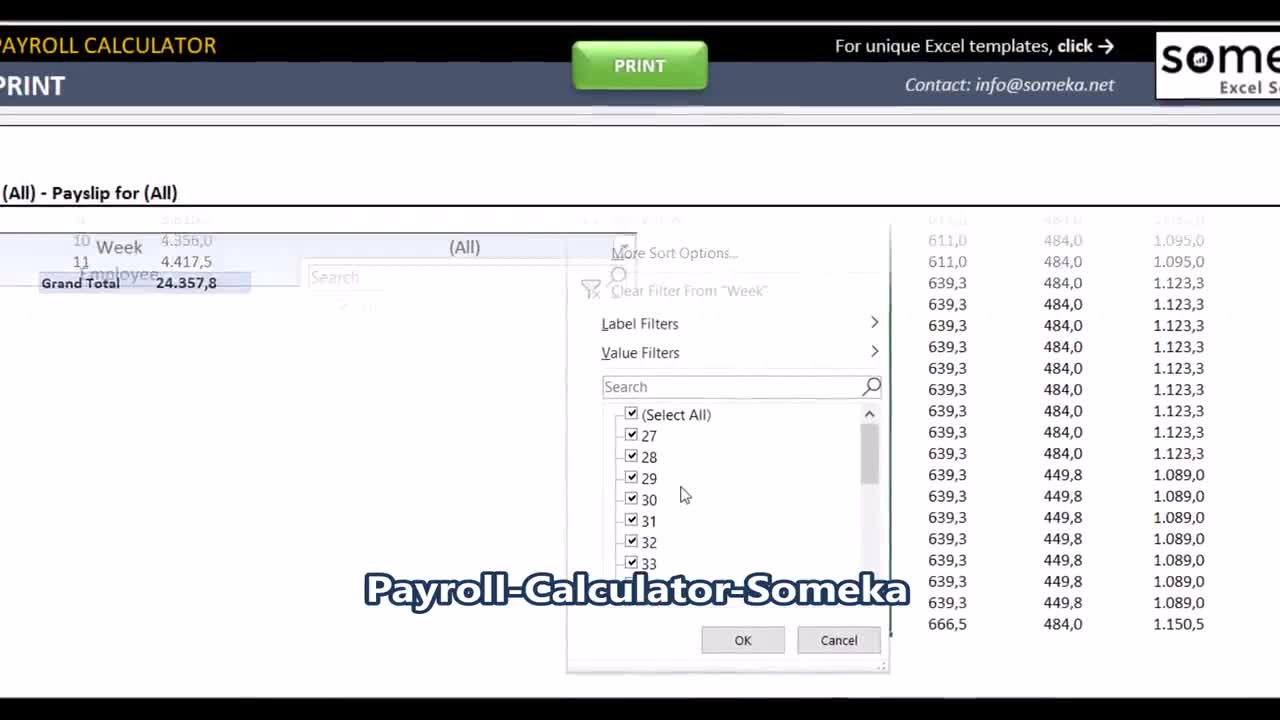

Payroll Calculator Excel Template To Calculate Taxes And Etsy Canada

Estimate My Tax Return Online 50 Off Www Ingeniovirtual Com

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Free Employee Payroll Template For Excel

Tax Calculator Estimate Your Income Tax For 2022 Free

Payroll Calculator Free Employee Payroll Template For Excel

Georgia Paycheck Calculator Smartasset

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Child Support Daycare Costs

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Payroll Calculator Excel Template To Calculate Taxes And Etsy Canada

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Gross Profit

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Payroll Tax Calculator For Employers Gusto